Get Ready to File Your 2019 Tax Return With These Simple Tips

Now that the 2019 tax year is over, we’re entering the busy 2020 tax season. However, before you file your 2019 tax return, it’s a good idea to reacquaint yourself with U.S. tax laws. This is especially true this year, since the IRS announced some big changes.

Keep reading to learn how tax filing has changed for the 2019 tax year and tips for confusion-free filing.

There Are a Few Significant Changes for the 2019 Tax Year and Beyond

Our tax laws are continually changing. While some changes only impact specific demographics of taxpayers, we also saw some wider-reaching changes during the 2019 tax year. Here are some that you need to know.

Standard Deductions Increased Slightly

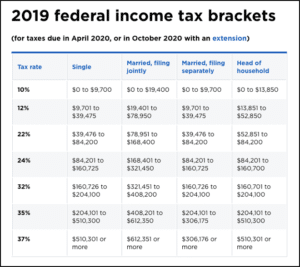

In 2019, the standard deductions increased modestly. They include $12,200 for single individuals and married couples filing separately, $18,350 for heads of household, and $24,400 for married couples filing jointly and qualifying widowers.

There No Longer Is a Federal Penalty for Being Uninsured

Don’t have health insurance? For your 2019 return and going forward, you don’t have to worry about the individual mandate penalty for being uninsured, at least at the federal level. Some states have individual mandates, meaning you still could face a penalty for being uninsured on your state return.

Maryland does not have an individual mandate in place for the 2019 tax year. However, our lawmakers are considering a mandate for future years – and we’re closely monitoring this issue.

New Federal Tax Brackets

There’s a New W-4 Form

If you start a new job in 2020, you’ll notice significant changes to the W-4 form. The main difference is that the IRS has done away with withholding allowances. According to the IRS, the new W-4 form decreases the complexity of filing and increases the accuracy of our withholding system. However, the new form could impact your refund if you do not initially withhold as much. If you have questions about your W-4 form, contact our office.

RELATED: Should You Break Even or Make Bank on Your Tax Returns?

Other Changes on Your 2019 Tax Filing

- Mortgage Interest: Available deductions for mortgages on primary residences taken after 2017 have decreased. You can deduct mortgage interest on total principal not exceeding $750,000 in qualifying loans, or $375,000 for married taxpayers filing separately.

- Casualty and Theft Loss: Personal casualty and theft losses of an individual are only deductible if they result from a federally declared disaster. Read Instructions for Form 4684 for more information.

- Medical Expense Deductions: For 2019 tax filing, you can only deduct the portion of medical expenses that exceeds 10% of your adjusted gross income (up from 2.5% last year).

5 Tips for Filing 2019 Taxes in 2020

1. Work Towards Lowering Your Tax Bill All Year Long

You can make retirement and other account contributions, plan itemized deductions, and research exemptions and credits throughout the year. All these actions help you lower your overall tax liability. By working on reducing your taxes all year long, you can avoid the hassle of trying to figure everything out at once.

2. File Your Return Early

Many taxpayers don’t want to start thinking about their taxes until they absolutely have to, especially if they handle tax filing on their own. But there are benefits to filing early, such as potentially receiving your return faster and having extra time to identify all your exemptions.

Additionally, filing earlier may help protect you from scammers who use your information to file and steal your return. If you file before the scammers do, the IRS generally flags their duplicate return.

3. Collect Your Documents in One Place

Depending on your tax situation, you likely need a variety of different documents to file your taxes. You should collect all your recent bank statements, invoices, 1099s, W-2s, receipts, and other documents in one place so that you have everything you need to file.

4. Reference Previously Filed Returns

For many taxpayers, their tax returns don’t change drastically from year-to-year. Unless you’ve had a child, gotten married, moved, or experienced another significant life event, your filing process may be similar to the previous year. Using previous returns as a reference can help you remember deductions and credits you included last year, and how to fill out the trickier parts of your return.

RELATED: 4 Reasons You’ll Want to Keep Your Tax Returns (And How to Keep Them)

5. Outsource Your Tax Calculations and Filing

Tax experts recommend that business owners, the self-employed, and individuals who have complex filing circumstances seek out qualified practitioners to assist with their tax filing. Hiring an accountant or tax service helps ensure that your taxes are done right. Additionally, tax experts can help you identify possible qualifying deductions you missed or didn’t even know existed. Even if you already filed a return on your own or with a qualifying practitioner, a tax expert may be able to help you amend any returns within the last three years to acquire missed deductions.

The experts know how to identify and apply all possible tax exemptions and save you money. Individuals who have experienced significant life events or who want to avoid the time and hassle of filing should also consider hiring an expert.

Need Help With Your Taxes? Contact S.H. Block Tax Services

Rather than stressing over how to file and wondering if you are missing any possible deductions, hire the tax specialists at S.H. Block Tax Services. We’re here to help you file your taxes and optimize your returns by identifying all your exemptions.

Have any questions about our services or a complication with your taxes? Contact us today by calling (410) 872-8376 or completing this brief online form.

References

Sheen, R. (13 March, 2019). Is Maryland the next state to approve an individual mandate? The ACA Times – Articles. https://acatimes.com/is-maryland-the-next-state-to-approve-an-individual-mandate/

The content provided here is for informational purposes only and should not be construed as legal advice on any subject.

Leave a Reply

Want to join the discussion?Feel free to contribute!