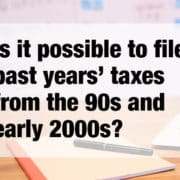

Q: Is it possible to file past years’ taxes from the 90s and early 2000s? How can I get the IRS off my back, they have attached a lien on my pay?

A: Hello friend, in short yes. It is possible to file taxes from the 1990s and early 2000s. However, your question is more complex. First, if you are referring to the IRS it may not be in your best interest to file taxes that are older than six years. This determination of filing needs more investigation. If you are referring to Maryland State Tax Returns, there is no statute of limitation and you will probably have to file those older years. This can be done using your transcripts, Form 4506-T, and requesting information via the Freedom of Information Act. However, you may need an attorney to guide you through the process of removing the lien, becoming compliant, and getting the IRS off your back.