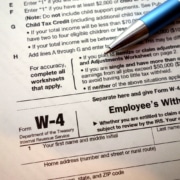

How Do I Know if I Am Exempt From Federal Withholding?

Many people don’t know how to figure out whether they need to withhold federal income taxes from their paychecks. That’s okay — the team of experienced tax representatives at S.H. Block Tax Services is here to help! In this blog article, we’ll talk about how withholding works and explain how you can figure out whether you’re exempt.